Fueling Business through Financial Excellence

Providing the capital Small Business Uses To Thrive

Driving Growth, Amplifying YOU

Lowest rates and most diversified lending products on the market today

Boosting Your Business

With Responsible Business Term Loans

Business Term Loan

Term Loans are the most common way small businesses obtain funds to make significant capital investments. You have probably heard them referred to simply as "small business loans."

Lines of Credit

When you're approved for a Business Line of Credit you'll have an established credit line up to any amount. You'll be able to draw funds from your credit line at any time you desire.

Invoice Factoring

With Invoice/Receivables Financing, we connect you with a third-party company known as an accounts receivable "factor." You sell your unpaid invoices to the factor at a discounted rate (generally, 85% to 90% of the invoice).

Equipment Financing

Equipment financing is very similar to a typical small business term loan. You can borrow up to 100% of the amount you need to buy the targeted equipment. When you pay off the loan principal, you own the equipment.

Your Partner in

Business Excellence

Financing Demystified, Accessible Capital

Strategize, Capitalize, Succeed

Focusing on YOUR Growth, YOUR Goals

Jenn O.

Shawn was patient and knowledgeable about what I was trying to accomplish. For sure ask for Shawn!

Simon W.

They've done a great job for us! As a restaurant owner, they provided much needed cash-flow.

Abigale C.

This was our first time gaining access to a term loan. We were so exicted by the opportunity to grow!

Strategic Solutions, Real Results

Business loans, SBA, and credit lines available with quick application & same day funding up to $1,000,000.

© 2026 Gunnar Solutions - All Rights Reserved

hello@gunnarsolutions.com

(888) 811-6101

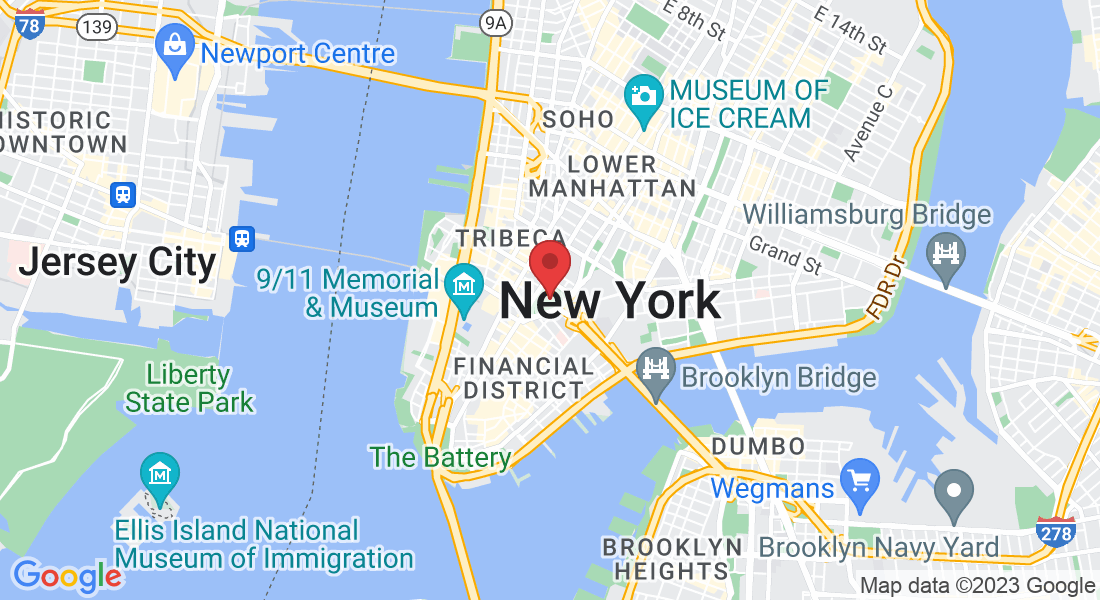

80 Broad St. suite 307

New York, New York 10006